The Community Foundation of Harrisonburg & Rockingham County can help you and your clients achieve their charitable giving goals.

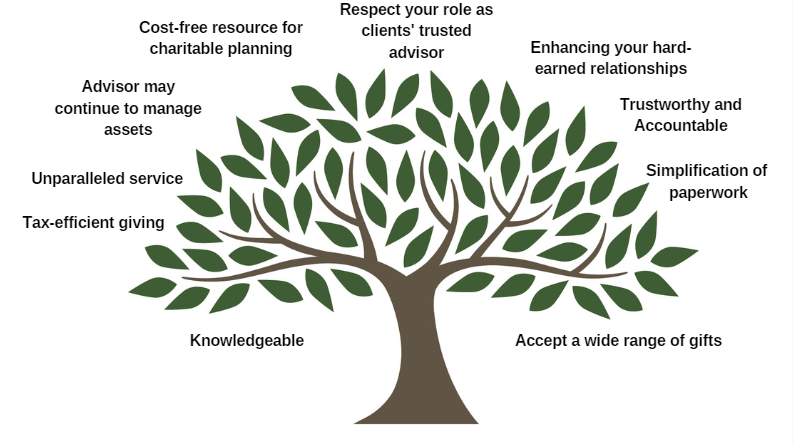

As a successful professional advisor, you have created a close relationship with your client. For most people, charitable giving is a big part of a sound financial plan. We know that you have the financial part of charitable giving covered, but let us help you with the charitable part.

We’ve built relationships with professional attorneys, financial planners and accountants to promote The Community Foundation’s easy facilitation of charitable giving in our community.

- Law Firms: We’re a resource for lawyers specializing in Estate Planning and Elder Law who are helping their clients manage estate plans and legacies by providing structured charitable giving options.

- Wealth Management Firms: We collaborate with Financial Advisors and wealth managers to help their clients find ways to donate money, securities, property and more complex gifts to grow our Community Endowment, answer the pressing needs of our community and build long-term support for the nonprofit of their choice.

- Accountants: We partner with CPAs and accountants to help facilitate tax-effective donations to the Community Endowment or nonprofits that complement the values and passions of their clients.

Below you will find a listing of the types of questions we have received from other advisors. Click on the links provided or contact us to learn more about how The Community Foundation of Harrisonburg & Rockingham County can help make charitable giving easier for you and your clients.

Some charitable giving options provide significant tax savings for your clients.

- Does your client need to make a large donation or an IRA distribution in the current year for tax reasons, but wants the ability to preserve all or a portion of the donation to grant out to nonprofit agencies over time?

- Does your client wish to receive a 65% Virginia state tax credit while supporting educational scholarships for students with financial need?

Area of Interest Funds target nonprofit services important to your clients.

- Do your clients have a specific areas (i.e., literacy, hunger, animal care, sports, education, etc.) to which they want to make charitable donations but they need assistance locating a reputable nonprofit service provider in that field?

Flexible options make charitable giving simple for your clients.

- Do your clients know what agencies they want to give to but are experiencing hurdles in making it happen? For example, they want to make a gift of appreciated securities but the nonprofit organization doesn’t have the capacity to accept it, or they want to make one donation of securities to multiple nonprofit agencies.

- Is your client interested in creating a scholarship, but not the administrative burden that goes along with promoting the scholarship, creating an application process, funding the scholarship, and monitoring the recipients?

- Does your client currently have a private foundation that has become too cumbersome to manage?

- Does your client want to make a planned gift to include in their will? Would they benefit from a third party to ensure their charitable wishes are being met even after they pass on?